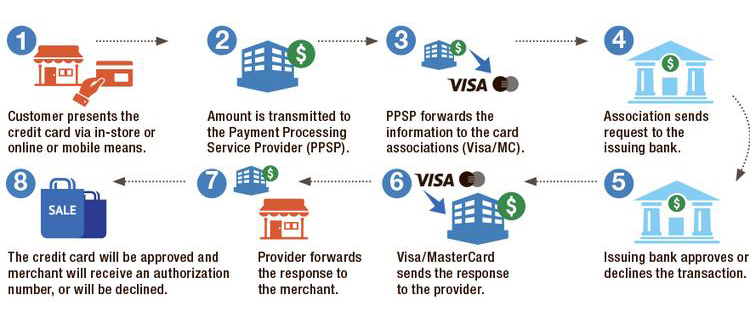

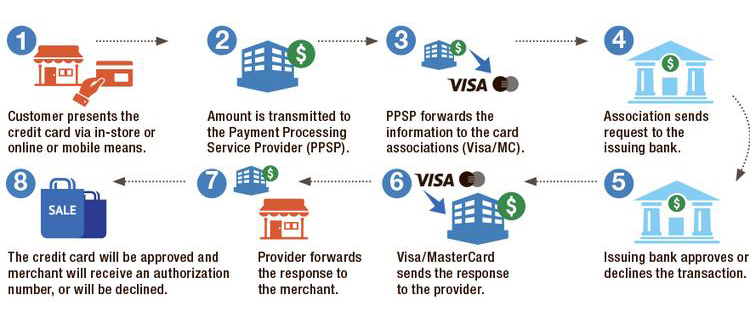

Together with our partner processing company, we provide payment processing solutions and merchant services to various markets and industries. Signature Payment Services enables you to accept payments from your customers anywhere, anytime. Our secure payment solution gives both you and your customers peace of mind. We offer enhanced online payment capabilities for better efficiency and an easy integration process. Our payment gateway solution is flexible, thereby reducing time and effort during the setup process.

Online transactions are processed in real time. A full transaction history and reconciliation reports are also available to enable you to manage your business efficiently. Created in full accord with PCI DSS (The Payment Card Industry Data Security Standard), Signature Payment Services payment gateway enables real-time transactions in 190 currencies.

Online transactions are processed in real time. A full transaction history and reconciliation reports are also available to enable you to manage your business efficiently. Created in full accord with PCI DSS (The Payment Card Industry Data Security Standard), Signature Payment Services payment gateway enables real-time transactions in 190 currencies.

Online transactions are processed in real time. A full transaction history and reconciliation reports are also available to enable you to manage your business efficiently. Created in full accord with PCI DSS (The Payment Card Industry Data Security Standard), Signature Payment Services payment gateway enables real-time transactions in 190 currencies.

Online transactions are processed in real time. A full transaction history and reconciliation reports are also available to enable you to manage your business efficiently. Created in full accord with PCI DSS (The Payment Card Industry Data Security Standard), Signature Payment Services payment gateway enables real-time transactions in 190 currencies.

PAYMENT GATEWAY FEATURES

A merchant account is a special bank account used to receive funds transferred by your customers’ credit and debit cards. Signature Payment Services provides flexible online business merchant accounts with real-time processing and instant access to our gateway for managing your payments. Our advanced SSL encryption and security features ensure all transactions and associated data are totally secure and protected against fraud. The rapid application process with approval is typically granted within 3 days, to get your business going in no time.

When processing card transactions you always need to be aware of the potential risks of fraud, and what you can do to prevent it. All systems, processes and procedures supported by Signature Payment Services adhere to the strictest fraud screening and prevention measures including transaction encryption, data protection and identity verification. We protect your business against fraud, decrease your chargeback ratio, whilst keeping your customers safe.

Signature Payment Services minimises chargebacks by identifying suspicious users and preventing unauthorised transactions in advance. All fraudulent activity is thoroughly analysed to prevent further cases and to avoid any potential losses. Completed, but unauthorised transactions are thoroughly investigated with a view to securing a full reimbursement.